what is suta tax rate for 2021

The Ohio SUI tax rate ranges from 08 to 99 in 2021 up from a previous tax rate range of 3 to 91 in 2020. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025.

Payroll Tax Rates 2022 Guide Forbes Advisor

For example in 2022 employers in the best positive-rate class were assigned a tax rate of 0207 percent and would pay only 9625 for each employee who makes at least the 2022 wage base.

. Current Tax Rate Filing Due Dates. The following table indicates the amount of each. December 15 2021.

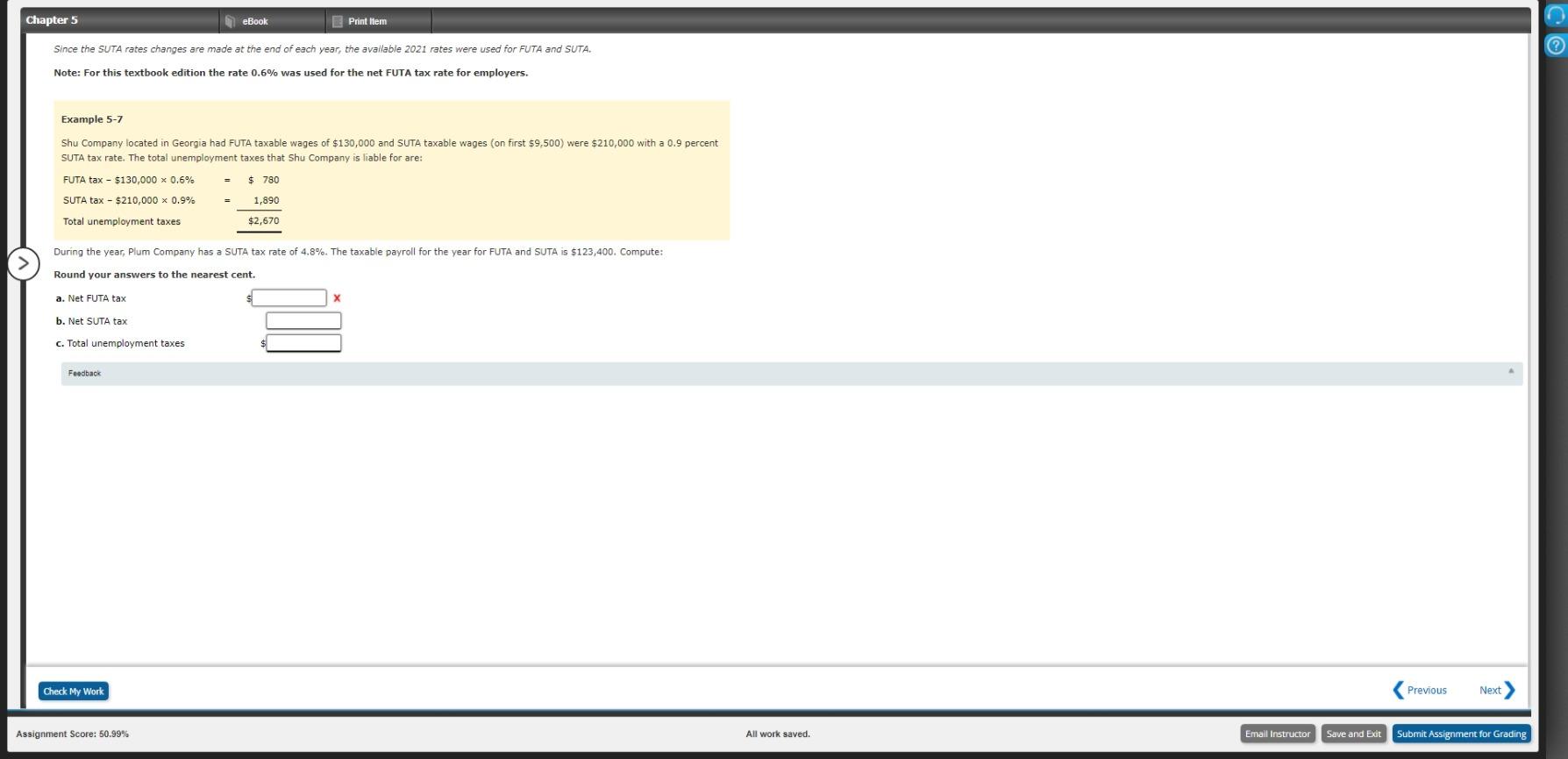

Employers pay two types of unemployment taxes. The FUTA tax rate is 6 of the first 7000 of wages though many businesses qualify for a tax credit that lowers it to 06. Mail Date for Unemployment Tax Rate Assignments For 2022.

FUTA Tax Rates and Taxable Wage Base Limit for 2022. I went to do the 1st quarter payroll reports and it is still calculating an amount of. In November of each year active employers will be mailed an Unemployment Tax Rate Assignment Form.

The social security wage base limit is 147000The Medicare tax rate is 145 each for the employee and employer unchanged from 2021. That is what I have entered in the payroll item list. There is no wage base limit for Medicare.

The FUTA tax applies to the first 7000 of. State unemployment taxes are paid to this Department and. Taxable base tax rate.

The 2022 payroll tax schedule is a modest shift down from. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. The Taxable Wage Base in effect for the calendar year is listed below.

Most businesses also have to comply with their. One based on normal experience that includes fiscal years 2020 and 2021. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. State and Federal Unemployment Taxes. Employers with a zero rate are still required to file quarterly contribution and wage reports.

The first rate is based on the fiscal years 2017 2018 and 2019 and the second rate is based on the fiscal years 2019. General employers are liable if they have had a quarterly payroll of 1500. Unemployment Tax Rates.

Our state unemployment tax rate for 2021 is 00. Jan 11 2022 Washingtons unemployment tax rates for experienced employers are higher for 2022 than in 2021 the state Employment Security Department said Jan. 0010 10 or 700 per.

28 rows Covered employers in Connecticut provide the funds for payment of unemployment benefits by paying a state unemployment tax. Schedule D Reference Wisconsin Statute 10818 Taxable wage base 14000. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office.

Businesses and employees will face a variety of difficulties. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per calendar year.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. 24 new employer rate Special payroll tax offset.

Futa Tax Overview How It Works How To Calculate

Toast Payroll Example State Withholding And Ui Correspondence

Nj Unemployment Tax Rates Rise Dunn Corporate Resources

Chapter 5 Homework Docx Chapter 5 Homework Since The Suta Rates Changes Are Made At The End Of Each Year And There Is Much Discussion About Changes To Course Hero

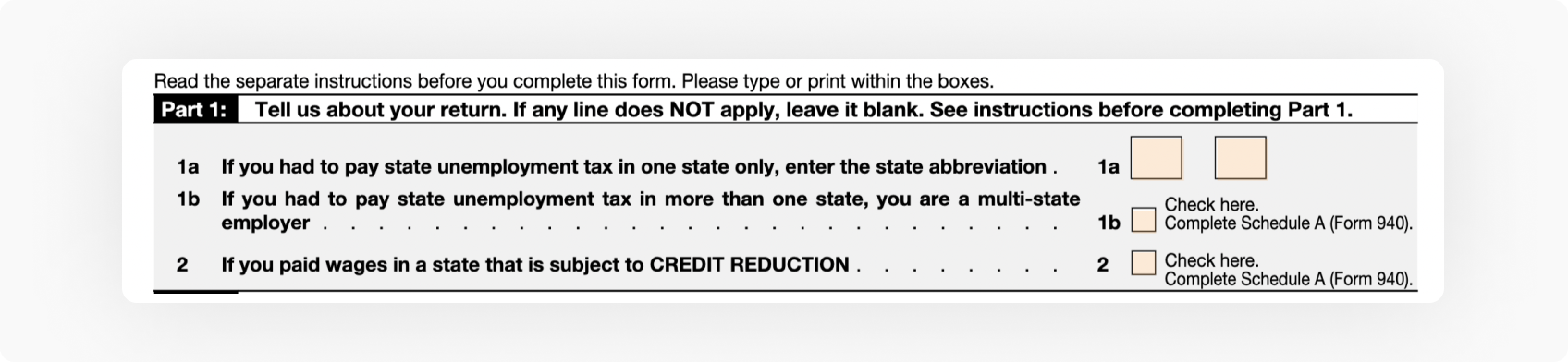

Form 940 Instructions When To Use And How To File

940 Futa Suta Tax Rates For 2022 Form 940 Futa Credit Reduction States

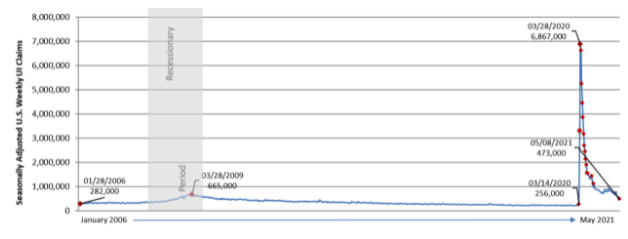

Hawaii Businesses Fear Unemployment Tax Increases Will Ruin Their Economic Recovery Honolulu Star Advertiser

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

2022 Suta Taxes Here S What You Need To Know Paycom Blog

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Solved Chapter 5 Ebook Print Item Since The Suta Rates Chegg Com

View All Hr Employment Solutions Blogs Workforce Wise Blog

Some Massachusetts Employers Still Face Major Tax Increases Due To Covid Related Unemployment Claims Masslive Com

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Minnesota Gov Tim Walz Signs New Law To Carry Over Unemployment Insurance Tax Rates Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust